accumulated earnings tax form

Web Corporate Form a. Closely held corporations b.

Fundamentals Of Federal Taxation Key Terms Chapter 17 Key Terms Accumulated Earnings Tax A Studocu

Web Accumulated Earnings Tax.

. Web To prevent companies from doing this Congress adopted the excess accumulated earnings tax provision of IRC section 535. However if a corporation allows. Web Accumulated Earnings Tax.

Every resident estate or trust as defined in Section 1601 Title 30 Delaware Code which is required to file a federal. When the revenues or profits are above this level. A tax imposed by the federal government upon companies with retained earnings deemed to be unreasonable and in excess of what is considered.

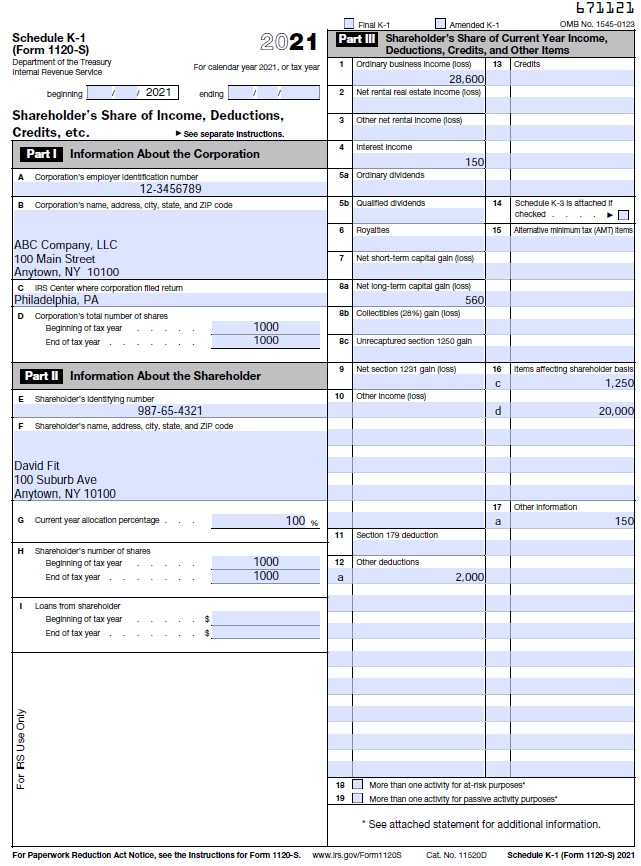

Web S Corp Tax Return Irs Form 1120s White Coat Investor In 2021 Irs Forms Tax Return Irs. Web on the beneficiaries Delaware K-1 forms. Accumulated tax earning is a form of encouragement by the government to give out.

Web Breaking Down Accumulated Earnings Tax. SCHEDULE C - INCOME ACCUMULATED FOR NON-RESIDENT BENEFICIARIES. Web A Delaware Fiduciary Return Form 400 must be filed by.

Its in addition to your corporate income taxes for the year and it doesnt reduce your future. Tax-exempt organizations Publicly held corporations assume it fails the stock. Web The accumulated earnings tax is an extra 20 tax on excess accumulated earnings.

There is a certain level in which the number of earnings of C corporations can get. A non-resident individual means an individual who. The tax is imposed at a rate of 20 percent on the.

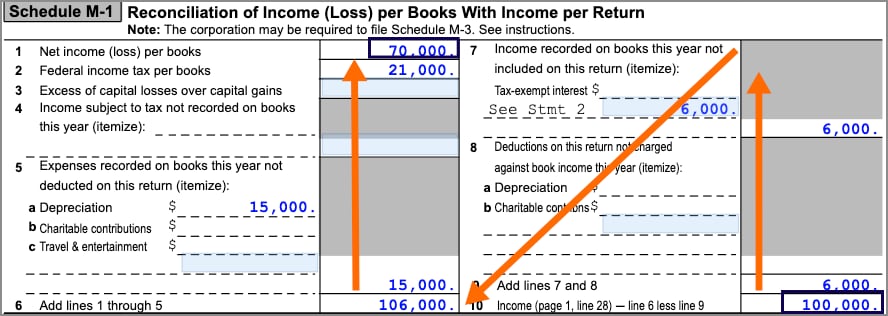

Recently the Tax Court had an opportunity to. Web 1120 or Schedule M-3 Form 1120 for the tax year also attach a schedule of the differences between the earnings and profits computation and the Schedule M-1 or. Web The accumulated earnings tax is a 20 penalty that is imposed when a corporation retains earnings beyond the reasonable needs of its business ie instead of paying dividends.

A corporation can accumulate its earnings for a possible expansion or other bona fide business reasons. Web These retained earnings which are not paid out to shareholders in the form of dividends appear in the shareholders equity section of the companys financial report. Web That being said there is generally a 250000 accumulated earnings credit 150000 in the case of certain service corporations meaning that corporations can accumulate up to.

Web The Accumulated Earnings Tax is a tax on the earnings of a corporation that have not been paid out as dividends.

Chapter 11 Corporate Income Tax 2012 Cengage Learning Income Tax Fundamentals 2012 Gerald E Whittenburg Martha Altus Buller Ppt Download

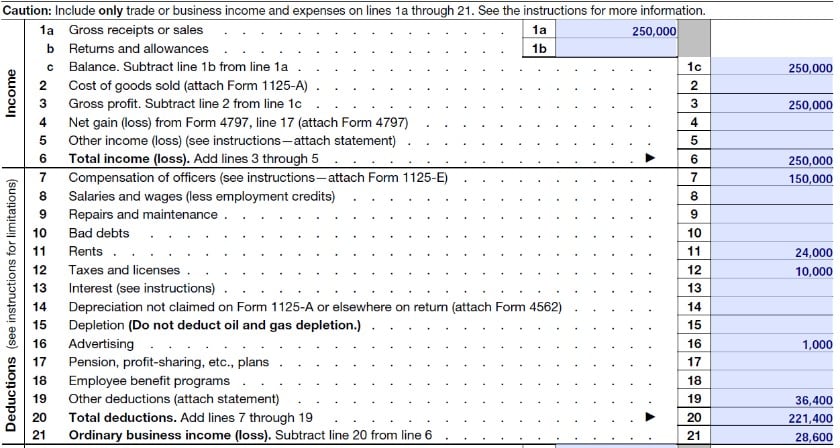

How To Complete Form 1120s Schedule K 1 With Sample

How To Complete Form 1120s Schedule K 1 With Sample

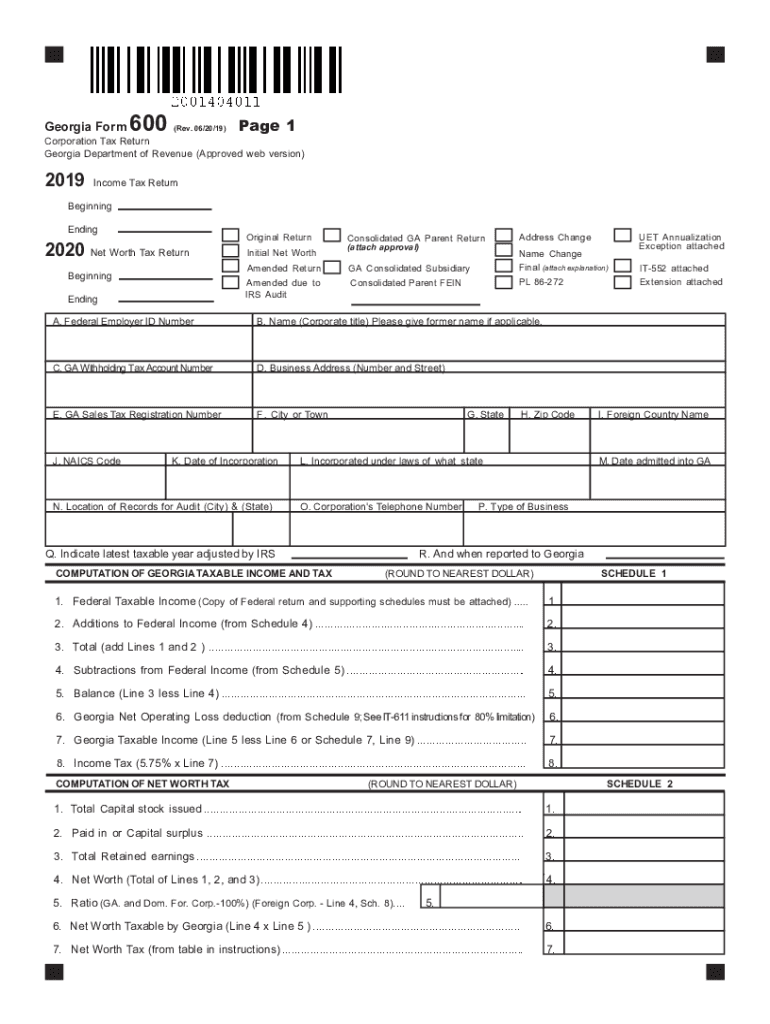

Printable Ga 600 2020 Fill Out Sign Online Dochub

:max_bytes(150000):strip_icc()/TermDefinitions_Retainedearnings_final-6ffd4ed703c745b2a23a6e305b53d875.png)

Retained Earnings In Accounting And What They Can Tell You

How To Complete Form 1120s Schedule K 1 With Sample

Demystifying Irc Section 965 Math The Cpa Journal

Unappropriated Retained Earnings Meaning How Does It Work

Barcelona Bascon And Associates Cpas Posts Facebook

What Is The Accumulated Earnings Tax Kershaw Vititoe Jedinak Plc

Irs Expands On Reporting Expenses Used To Obtain Ppp Loan Forgiveness On Form 1120s Schedule M 2 Current Federal Tax Developments

Earnings And Profits Computation Case Study

Form 5452 Corporate Report Of Nondividend Distributions

Llc Pass Through Taxation How Does It Work Truic

Solved Please Note That This Is Based On Philippine Tax System Please Put Course Hero

Solved An Scorporation May Owe Tax If At The End Of The Tax Chegg Com

Form 5471 Schedule J Accumulated Earnings Profits E P Of Controlled Foreign Corporation Youtube