r&d tax credit calculation example

Prepare Your RD Credit Get Cash Back. If in 2022 A to Z Construction had qualified research expenses of 70000 they would calculate the available RD credit as follows.

Grade 6 Lab Report Template 2 Templates Example Templates Example Lab Report Template Report Template Lab Report

Regular research creditThe RRC is an incremental credit that equals.

. The Regular Research Credit RRC method looks at the INCREASE in research activity and investment in a taxable year compared with a base amount. Find Out If You Qualify For The RD Tax Credit. Identify and calculate the companys average qualified research expenses QREs for the prior three years.

Use Our RD Tax Credit Calculator To Find Out If Your Business Is Eligible For An Offset. Multiply average QREs for that three year period by 50. The taxpayer multiplied this estimate by.

Claiming the Regular Credit for research and development operations can be complex. NeoTax Prepares a Study and Filing Instructions for Your CPA. Artificially increasing your RD expense for the year and reducing your taxable profit.

70000 - 24167 45833 x 14. According to the Joint Committee on Taxations JCT most recent tax expenditure report the RD tax credit will reduce tax revenue by about 118 billion in 2020106 billion. Ad Early Stage Startups Can Claim the RD Tax Credit.

Find Out If You Qualify For The RD Tax Credit. RD Tax credit is a non refundable amount that taxpayers subtract from their total taxable income when filing taxes. For example prototypes that are created and used in RD and subsequently sold to customers can be included in the tax credit calculation.

Subtract your original CT amount from your new. When subtracting it from the original corporation tax before the claim the total saving for this. Now as appears from the above youve carried out RD activities and youve calculated the qualifying expenditure to be 100000.

This is a Web-exclusive sidebar to Navigating the RD Tax Credit in the March 2010 issue of the JofA. A basic breakdown of each section on Form 6765 includes. NeoTax Prepares a Study and Filing Instructions for Your CPA.

Use Our RD Tax Credit Calculator To Find Out If Your Business Is Eligible For An Offset. RD Tax Credit is 287500 1454168750 CT600 boxes 530 875 Losses to carry forward 275000 Example 2 Using the same qualifying cost additional deduction and. Prepare Your RD Credit Get Cash Back.

Youll therefore multiply this amount by 130 and. Add the total QREs for the current tax year. Find the fixed base percentage.

There are two standard methods of calculating the RD tax credit -- the regular research credit RRC method and the alternative simplified credit ASC method. Add the annual QREs over the previous four years. Enhance your QE by multiplying by 130.

Multiply the result in step 3 by. Ad Early Stage Startups Can Claim the RD Tax Credit. In Trinity Industries Inc.

This credit appears in the Internal Revenue Code section 41 and is. The controller then added the amounts calculated for each employee to calculate the initial estimate of total wages incurred for qualified services.

R D Tax Credit Calculation Examples Mpa

R D Tax Credits Calculation Examples G2 Innovation

R D Tax Credit Calculation Examples Mpa

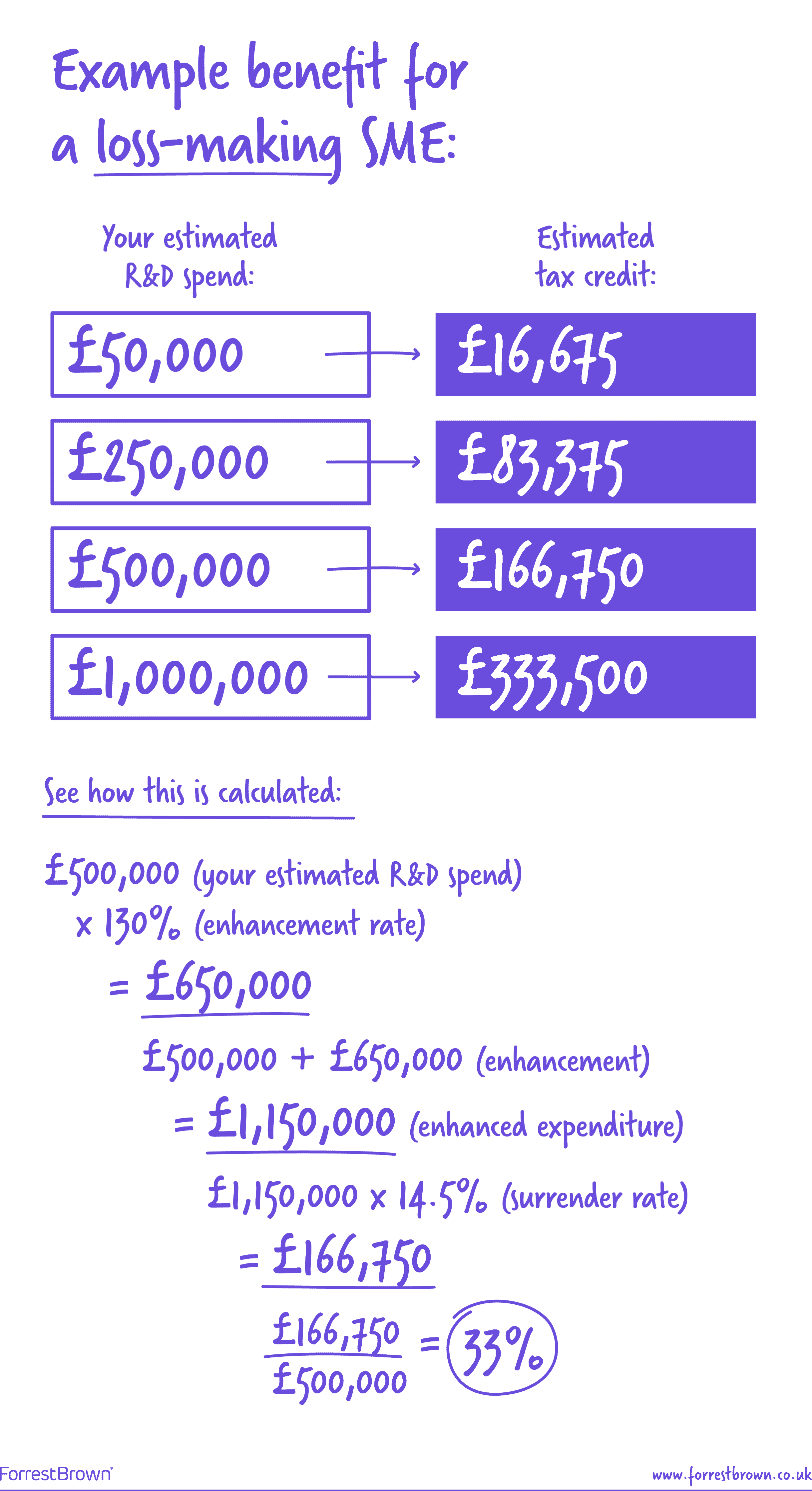

R D Tax Credit Rates For Sme Scheme Forrestbrown

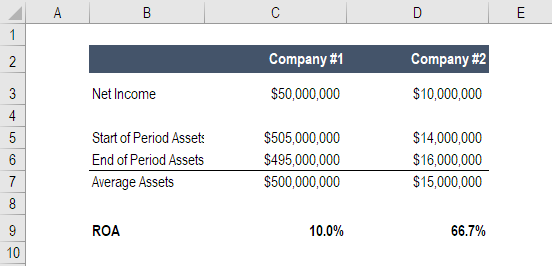

Return On Assets Roa Formula Calculation And Examples

Effective Tax Rate Formula And Calculation Example

Rdec 7 Steps R D Tax Solutions

Taxable Income Formula Examples How To Calculate Taxable Income

State R D Tax Credits Are You Missing Out Wipfli

Free Personal Financial Plan Template Financial Plan Template Financial Planning Business Plan Template

R D Tax Credit Calculation Methods Adp

Payback Period Formula And Calculator Excel Template

R D Tax Credit Calculation Methods Adp

R D Tax Credit Calculation Examples Mpa

Tax Exemptions Deductions And Credits Explained Taxact Blog

Rdec Scheme R D Expenditure Credit Explained

Depreciation Formula Calculate Depreciation Expense